Bitcoin Mining Pools Reviews

Mining in a pool is the best way for small to average bitcoin miners to achieve better results. When miners combine their hash power and split the rewards, all of them will receive a constant income proportional to their hash rate. Solo miners, on the other hand, get the full block reward, but the time required for finding a block depends on their luck and it can take months or even years to mine a block successfully.

Choosing the right Bitcoin mining pool will help you optimize your profitability and predict your future rewards. This page will provide you with all the necessary information to make the best choice of a Bitcoin mining pool, and you can also use the calculator to help you find out how much profit you can expect.

1.00000000 BTC

| Total Hashrate: | 988,857,305,104 GH/s |

|---|---|

| Difficulty Level: | 119,116,256,505,723 |

| Block Time: | 8 min 2 sec |

| Actual Block Reward: | 3.125 BTC |

Best Bitcoin Mining Pools

If you have no experience, it’s easier if you choose one of the biggest mining pools, based on their hash rate distribution. Bigger pools offer stability, frequent earnings, and low limit payouts but they might charge you with a little higher fee than the smaller ones.

Here is a list of the best Bitcoin mining pools with their market share, server locations, reward system(s) and their average fee:

| Pool Website | Market Share/Hash PWR* | Server Locations | Reward System | Pool Fee | Get all Details |

|---|---|---|---|---|---|

| BTC.com |

26.4 %

|

Asia

EU

USA

|

|

1.5% |

Read Review

|

| Antpool |

13.6 %

|

Asia

USA

EU

|

|

3%-5% |

Read Review

|

| Slushpool |

11.9 %

|

EU

Asia

USA

|

|

2% |

Read Review

|

| ViaBTC |

9.4 %

|

EU

Asia

USA

|

|

2%-4% |

Read Review

|

| F2Pool |

8.4 %

|

USA

Asia

EU

|

|

3%-5% |

Read Review

|

*Statistics are a rough estimate and can’t be 100% accurate.

There are a few other factors that may influence your decision, so I recommend you to take everything into consideration. You can take a look at all of them in the guide – “How to choose the right mining pool”, which you can find on the homepage. Your earnings also depend a lot on the reward systems the pools are using. You can find more information about how all of them work in the article “Mining pools reward systems”.

Keep in mind that when some pools experience problems, that may cause downtime. So, better think about a second or even a third mining pool as a failover. That will give you 100% uptime if one of the pools is down.

Mining Pools Without Registration

Most of the BTC mining pools require a simple registration so you can keep your workers organized and receive notifications and statistics regarding your mining. The process of registration in a mining pool is simple and easy. You need to create your desired username and then worker name for all your miners. The only requirement for user registration is an e-mail address which you can later use to receive notification about the status of your miners.

If you care about privacy and don’t want to register in a pool, you can choose from the best Bitcoin mining pools list I’ve prepared, showing pools, which don’t require registration:

| Name | Fee | Pool Url | Worker | Password |

|---|---|---|---|---|

| Ckpool | 0% | pool.ckpool.org:3333 | YOUR Public Bitcoin address | Any |

|

Eligius

|

0% | stratum.mining.eligius.st:3334 | YOUR Public Bitcoin address | Any |

| P2pool | 0% | mine.p2pool.com:9332 | YOUR Public Bitcoin address | Any |

And now what? It’s actually pretty easy – each mining gear has a software, which you connect to the pool of your choice. No registration means no private information on the website of the pool. For Bitcoin, in particular, you need to adjust the AISC’s software from your PC. There are no public websites involved here. Open your miner’s software folder and use the quickstart parameters for each pool. Copy and paste them so you avoid making mistakes.

Calculating My BTC Pool Mining Profits

Values in the crypto world are constantly changing. This is why I have provided you with a user-friendly calculator that you can use to see how much profit you are going to make from Bitcoin mining at any given time. Enter your miner’s hash rate, power consumption, electricity cost and pool fee in the empty fields and click “calculate”.

What’s even better is that you can also calculate your cloud mining profit. This is even easier, as all you need to do is just enter the hash rate and the pool’s fee. The calculations are based on the current difficulty and current market price. It’s approximate and not always 100% accurate, so make sure you keep that in mind.

The software will output your daily, monthly and yearly profit. Also, you can see the approximate amount of coins you are going to mine and how much money you will spend on electricity costs. When checking your cloud mining calculations, you just have to make sure your profit outweighs the costs you’re paying for the service.

Setting Up Your Own Bitcoin Mining Pool

Setting up your own Bitcoin mining pool could be a very lucrative undertaking. It means that you will not only be receiving a portion of the mined reward, but you could also be collecting fees from your miners. Moreover, you will also be contributing for the decentralization of the mining power within the Bitcoin network. However, I should say that setting up a pool is not very easy. It’s usually involved with a lot of resources, advanced knowledge and free time. But don’t worry, here I have provided you with a list with the minimum hardware and software requirements for running your own BTC mining pool:

- Dual-Core Processor

- 4GB of RAM

- 250GB of hard disk space to house the blockchain for this coin

- Unlimited Bandwidth Usage incoming and outgoing traffic depends on how much users are connected to your pool

- Dedicated public IP Adress for guaranteed uptime I recommend a VPS

If you plan to start your own mining pool, and you don’t have the required hardware by hand, the best option is to rent a VPS server with the minimum requirements, where you can install the mining pool software. It’s much more reliable and you don’t have to worry about running a physical machine, about the electricity, bandwidth or about the possible downtime.

Bitcoin Pool Distribution by Countries

It’s not a secret that China controls around 60% to 70% of the Bitcoin network’s hash power. That’s because the electricity in China is cheaper than in most countries, which allows Chinese mining farms to generate big profits. Also, there are rumors that some power companies in China direct their excess energy to Bitcoin mining farms to minimize their energy waste, thus making mining even easier and cheaper for them. I have prepared the following map of BTC mining pools distribution to imagine how exactly does it look like from a worldwide perspective:

Distribution by Countries

It’s not a secret that China controls from 60% to 70% of the Bitcoin network hash power. That’s because the electricity in China is cheaper than most of the other countries and that allowed Chinese mining farms to make a big profit. Also, people rumored that some power companies in China direct their excess energy to Bitcoin mining farms to minimize their energy waste.

| No | Pool Name | Market Share (%) |

|---|---|---|

| 1 |

China

|

63.4 %

|

| 2 |

Iceland

|

7.5 %

|

| 3 |

Georgia

|

5.9 %

|

| 4 |

Sweden

|

4.7 %

|

| 5 |

Norway

|

4.3%

|

| 6 |

Bulgaria

|

3.9%

|

| 7 |

USA

|

3.4%

|

| 8 |

Germany

|

2.7%

|

| 9 |

Russia

|

2.3%

|

| 10 |

Canada

|

1.9%

|

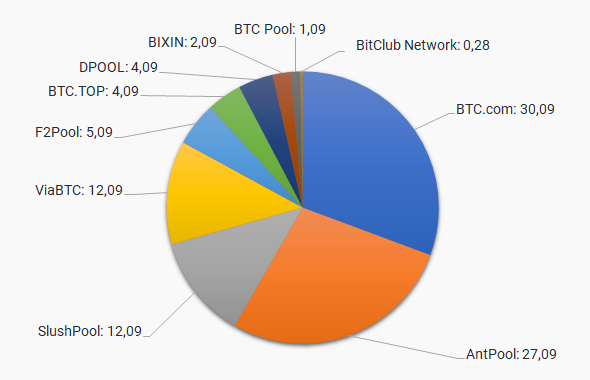

Centralization of All Bitcoin Mining Pools

The biggest issue in the Bitcoin peer-to-peer ecosystem is the higher level of centralization which can lead to 51% attacks. This is a possible scenario, leading to major issues for the integrity of the blockchain. This would allow malicious attackers to change block transactions, double spend or even change consensus rules.

Back in July 2014 one of the mining pools held more than 51% of Bitcoin’s hash rate which forced developers and pool owners to make sure that Bitcoin mining remains decentralized. The pool voluntarily committed to reduce its share of the network and said in a statement that in the future it would not reach even 40% of the total hash power.

Miners should understand that centralization of the network and possible 51% attacks are not healthy for the system and lead to Bitcoin price drops and loss of confidence for the new investors. That’s why I advise you to opt out of bigger pools, if you see a potential danger to the system, and join a BTC mining pool with the lower market share if that is possible.

Here is a Bitcoin mining pools comparison of the best ones at the time of writing this article, where you can see their key parameters:

| Pool | Hashrate Share |

|---|---|

|

BTC.com

|

30.09% |

|

AntPool

|

27.09% |

|

SlushPool

|

12.09% |

|

ViaBTC

|

12.09% |

|

F2Pool

|

5.09% |

|

BTC.TOP

|

4.09% |

|

DPOOL

|

4.09% |

|

Bixin

|

2.09% |

|

Btcc Pool

|

1.09% |

|

BitClub Network

|

0.28% |

As you can see from the table, the top 5 pools control 70% of the network. Another interesting thing is that all of them are Chinese based.

History and Future of Bitcoin Mining Pools

With the increasing difficulty and lowering performance of mining devices, the need for pooled mining led to the creation of the Bitcoin mining pools. In November 2010 the first Bitcoin pool known as Slushpool was announced. It was unique with its score-based reward system where older shares have a lower weight than recent shares, which reduces the cheating possibility for pool hoppers who are switching between pools within a round. To avoid centralization, other mining pools also started to operate over time with different reward systems, trying to fairly distribute the shares and rewards to miners. In the future, pool mining will still exist in some form and it will be a good option for small to average miners to earn rewards instead of waiting too long to solve a block.